Modern Monetary Theory

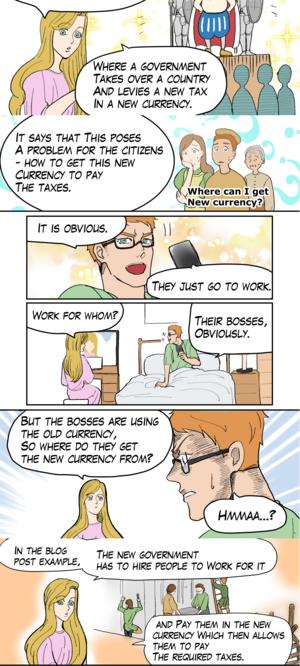

Modern Monetary Theory (MMT), alternatively known as Mosler Economics, Neo-Chartalism, the Kansas City Approach and soft currency economics, is a highly influential and emerging economic school spearheaded and financed by hedge fund manager and perennial independent political candidate Warren Mosler. This economic school argues that the concept of unemployment is initially created via a violent threat to pay taxes via a non-issued, government monopolized, fiat currency. It further argues that this government is the first issuer of the currency to (now motivated) paid work seekers, and then it collects and maintains the value of this currency via further violent threats. (spend first, tax later) MMT states that without further violent threats to pay taxes, no citizen would value the currency, and the value of the currency would be 0.[notes 1] MMT argues that to control unemployment which is necessarily a result of taxation, unemployment can be reduced or eliminated through decreasing taxes and/or increasing spending directed at job growth. According to MMT, the control and availability of real resources are the main determinants of inflation from federal government deficits in nations with a fiat currency.

MMT rejects that issuers of a currency are constrained in spending the same way that users of a currency are. MMT argues that governments who are the sole issuer of their currency cannot involuntarily default on that currency, and that their federal government debt is just a record of private sector savings. Rejecting monetarism, MMT also rejects the idea that an increased size of the US federal government debt is automatically an indicator of emerging inflation.

MMT vs Neo-Keynesian Economics

MMT is different than Keynesianism in that Keynes argued that fiscal deficits should be balanced when the economy is running hot to pay back previous debt. MMT rejects this mode of thinking in that they don't believe the US federal government fundamentally owes any money to itself. Neo-Keynesians (like Paul Krugman) often attack MMT as being substantially wrong and also not substantially different from their own theory. If this doesn't make sense, that's because it doesn't.

Here are some of the differences between MMT and Neo-Keynesianism:

Inflation projection and price setting

MMT argues that Neo-Keynesians and similar economic schools ignore that inflation in developed nations is usually a result of price setting (or lack thereof in the face of cost-push inflation). MMT argues that this is important because the government is a price setter and not a price taker, and therefore has much more influence over prices than Neo-Keynesian economists would say. MMTers argue further that this leads Neo-Keynesian-aligned economists and similar economists to spend too much time foolishly looking at bond price projections for inflation information rather than the government's fundamental function as the price setter.

Tax/spend sequence differences

MMT states that federal governments deficits never spend taxpayer revenue and always dispose of it, which is different than Neo-Keynesianism and most economic schools. Neo-Keynesians and most other economic schools assume that governments tax before they spend, whereas MMT argues that governments spend before they tax.

Monetary policy and interest rates

MMT also argues that Neo-keynesianism and most other economic schools mistakenly believes the US Federal Reserve has a meaningful ability to stimulate the economy in a non-inflationary and non-regressive manner.

US federal government deficits and private investment

Neo-Keynesians like Paul Krugman believe that US federal government deficits crowd out private investments by competing with private borrowing for private savings. MMT rejects this and instead argues that government deficits, in 'monetarily sovereign nations' like the USA, are a source of private sector savings and so don't discourage private investment.

As mentioned earlier, Keynesians in general believe in tightening the budget when the economy is running hot because they often believe the US federal government should, at some point, pay back money it owes to itself. MMT rejects this as they believe the US federal government debt is just a record of private sector savings, and that the US federal government doesn't fundamental owe any money to itself. Prominent socialists who borrow from Keynes and progressivism have expressed desires to balance the budget when unemployment is low or falling. Popular socialists like Jeremy Corbyn[1] and Bernie Sanders[2] are both known to do this, which MMT blames on Keynesian influence on popular, modern socialists.[3] Attempts by MMT proponents to get some popular, modern socialists to publicly rethink government deficits has had mixed success, but mostly failed in the case of Sanders.

Some Neo-keynesians like Paul Krugman have been more dovish on federal government debt after MMT influence in the economic space. For example, Krugman has recently and tentatively stated that the US Federal government debt "may be just a number", but he also waffles on this and sometimes refers to the a rising federal government debt as an independent force with the potential to cause economic damage on its own.

Function of US Treasury bonds

Neo-Keynesians argue that when the US Treasury sells bonds it is borrowing money. Randall Wray and Warren Mosler, two of the most prominent MMTers argue that Treasury bonds are actually not a borrowing operation because the US Treasury cannot borrow its own money. Instead they posit that the treasury or the central bank selling bonds is monetary policy to get excess reserves out of the banks so that the interest rate doesn't fall.

MMT on international trade

The theory also argues that real resources are the main determinants of the cost/benefit of international trade with at least one monetarily sovereign government participating.

MMT proponents

Policy prescriptions from proponents

MMT argues that MMT is simply a description of the real world, and not a prescriptive theory. Publicized MMT proponents are close circles, however, and they often share policy recommendations. MMT proponents insist these are their own personal opinions informed by MMT rather than "MMT opinions" per se.

Income tax and corporate tax reduction

Mosler, the founder of the school, is notably against corporate taxation, believing that it punishes the economy and workers for little reason. Warren advocates for an elimination of all income tax in favor of other types of taxes.

Transitional job guarantee program

Most prominent MMT proponents primarily push a national transition jobs program which would pay workers minimum wage to transition as much of the unemployed into wage work as possible.

List of prominent proponents

Most of MMT's prominent proponents seem to be economics professors. University of Missouri - Kansas City (UMKC) at one point had an entire institute devoted to the theory called the Center for Full Employment and Price Stability, which is now defunct. While the UMKC is still referred to as an academic hub of MMT, MMT's most publicized proponents are from Bard College in NY State and Stony Brook University in NY State, as well as a couple Australian colleges.

University of Missouri - Kansas City

- Professor of Economics Mat Forstater

- Associate Professor of Economics Scott Fullwiler

Bard College

- Professor of Economics Randall Wray

- Professor of Economics Pavlina Tcherneva

Economic professors from other colleges

- Professor of Economics and Public Policy at Stony Brook University Stephanie Kelton

- Professor of Economics & Finance at the University of Western Sydney, Australia Steve Keen

- Chair in Government/Business Relations at the University of Texas at Austin, Lyndon B. Johnson School of Public Affairs Kenneth Galbraith

- Professor of Economics at University of Newcastle, NSW Australia Bill Mitchell

- Economics professor at New School for Social Research in New York City Ed Nell

Former US federal politicians

- 2019-2023 US Federal Congressional Budget Committee Chair John Yarmuth

Pundits

- Progressive and populist pundit Steve Grumbine

- Conservative libertarian YouTube channel Volitional Science Network

Traders

- Hedge fund manager Warren Mosler

- Former hedge fund manager, former floor trader, current investment advisor, pundit, and trader Mike Norman

Presence of MMT in prominent federal government campaigns and offices

2004 Bush administration

Mosler claims that the 2004 deficit spending during the Bush administration was as a result of a conversation Mosler had with a chief economist of the administration. This deficit spending was famous for its reduction of prescription drug costs.

2015 Congressional Budget Committee

MMT and at least one of its proponents, Stephanie Kelton, started entering the political establishment in 2015 via the US Democratic, Congressional House Budget Committee as a chief economic advisor.[4]

2016 Bernie Sanders presidential campaign

US senator Bernie Sanders hired Stephanie Kelton as his chief economic adviser for his 2016 presidential run.[4] At the same time, Sanders did not explicitly advocate much of the economic theory of his chief economic adviser. To the contrary, Sanders often spoke of needing to fund programs in such a way MMT says is an irrational way of looking at government spending. The contrast between Sanders and his economic adviser could be due to the fact that he personally agreed with the theory, but found stating the theory unpalatable to American voters who were already immersed in decades of neoliberal economic theory. It is also possible he did not understand the theory (like Richard Wolff did not understand for at least 5 years)[citation needed] and was just making trendy hiring decisions.

Unknown time during Trump presidential administration

Mosler also claims Donald Trump had someone who read and agreed with MMT theory as an economic adviser at some point during his presidential term.

2019-2023 Congressional Budget Committee

MMT arguably found its most vocal, elected proponent in 2019-2023 US Congressional House Budget Committee chair John Yarmuth, who, according to MMT economist Stephanie Kelton, read MMT economic texts and publicly promoted the theory.[5]

Notes

- ↑ This is related to the reason that MMT theorists believe that a "universal basic income" (UBI) would cause hyperinflation if it covered the costs of consumer spending. Because MMT believes a UBI in the United States would remove the threat of violence from taxation, causing people to not want to work for the government.